property tax assessor las vegas nevada

Contact your local Assessor for details. Show present and prior owners of the parcel.

111-11-111-111 Address Search Street Number Must be Entered.

. Occasionally some Assessor files are. Property Account Inquiry - Search Screen. Or Company Name Last Name Required.

Facebook Twitter Instagram Youtube NextDoor. Exemptions may be used to reduce vehicle Governmental Services Taxes or property taxes. Certain rural assessors also offer vehicle registration services.

Public Property Records provide information on land homes and commercial properties in Las Vegas including titles property deeds mortgages property tax assessment records and other documents. Briana Johnson Assessor Parcel Number Inquiry - Search by Parcel Number Please click which information is requested enter an Assessor Parcel number and click the SUBMIT button. Boulder City Bunkerville Enterprise Glendale Henderson Indian Springs Las Vegas Laughlin Mesquite Moapa Moapa Valley Mt.

House located at 4401 Edward Ave Las Vegas NV 89108 sold for 91500 on Mar 23 1998. The Clark County Assessors Office located in Las Vegas Nevada determines the value of all taxable property in Clark County NV. This is referred to as the tax cap.

See reviews photos directions phone numbers and more for Property Tax Assessor locations in Las Vegas NV. Henderson NV 89015 702-267-2323. The Assessor parcel maps are for assessment use only and do NOT represent a survey.

If the County Board after hearing your petition still agrees with the Assessors appraisal you may appeal the County Boards decision to the State Board of Equalization. City of Las Vegas Property Search. If you do not receive your tax bill by August 1st each year please use the automated telephone system to request a copy.

Grand Central Pkwy Las Vegas NV 89155. Ad Get In-Depth Property Reports Info You May Not Find On Other Sites. Find My Commission District.

A Las Vegas Property Records Search locates real estate documents related to property in Las Vegas Nevada. Property Tax Rates for Nevada Local Governments Redbook NRS 3610445 also requires the Department to post the rates of taxes imposed by various taxing entities and the revenues generated by those taxes. Assessor - Personal Property Taxes.

Several government offices in Las Vegas. Nevada county assessor offices grant tax relief to DMV customers. Treasurer - Real Property Taxes.

See the recorded documents for more detailed legal information. Parcel inquiry - search by Owners Name. View sales history tax history home value estimates and.

Las Vegas NV 89155 Grand Central Map Website. Las Vegas Planning Department 333 North Rancho Drive Las Vegas NV 89106 702-229-6301 Directions. The citizens of Nevada County deserve fair and equal implementation of California property tax laws and our goal is to ensure that taxpayers receive timely and accurate property assessments.

Access to Market Value Tax Info Owners Mortgage Liens Even More Property Records. 668 properties and 31 addresses found on Badura Avenue in Las Vegas NV. The average prope rty on Badura Ave was built in 2005 with an average home value of 47274.

Show present and prior owners of the parcel. Doing Business with Clark County. Taxable property includes land and commercial properties often referred to as real property or real estate and fixed assets owned by businesses often referred to as personal property.

Search City of Henderson property assessment records by parcel number owner name or street address. Las Vegas Building Department 731 South 4th Street Las Vegas NV 89101 702-229-6251 Directions. To calculate the tax on a new home that does not qualify for the tax abatement lets assume you have a Home in Las Vegas with a taxable value of 200000 located in the as Vegas with a tax rate of 350 per hundred dollars.

Account Search Dashes Must be Entered. The Treasurers office mails out real property tax bills ONLY ONE TIME each fiscal year. The Assessor parcel maps are compiled from official records including surveys and deeds but only contain the information required for assessment.

The Assessors Office recently mailed out Tax Cap Abatement Notices to residential property owners who purchased property or had a change in ownership after July 1 2021 in Clark. Las Vegas Tax Records include documents related to property taxes business taxes sales tax employment taxes and a range of other taxes in Las Vegas Nevada. Show current parcel number record.

The Assessors Office locates taxable property identifies ownership and establishes value for the tax assessment rolls. Make Real Property Tax Payments. The surviving spouse of a disabled.

Nevada City CA 95959. Charleston North Las Vegas Paradise Searchlight Spring Valley Summerlin. The Clark County Assessors Office located in Las Vegas Nevada determines the value of all taxable property in Clark County NV.

To qualify the Veteran must have an honorable separation from the service and be a resident of Nevada. Apply for a Business License. Please enter all information known and click the SUBMIT button.

Disabled Veterans Exemption which provides for veterans who have a permanent service-connected disability of at least 60. Show current parcel number record. Las Vegas NV 89155.

The amount of exemption is dependent upon the degree of disability incurred. The average lot size on Badura Ave is 67687 ft2 and the average property tax is 14Kyr. AOCustomerServiceRequestsClarkCountyNVgov 500 S Grand Central Pkwy Las Vegas Nevada 89155.

City of Henderson Property Search. You may find this information in Property Tax Rates for Nevada Local Governments commonly called the Redbook. Get Property Records from 2 Building Departments in Las Vegas NV.

Make Personal Property Tax Payments. Select an address below to learn more about the property such as who lives and owns. Check here for phonetic name match.

Tax Records include property tax assessments property appraisals and income tax records. If street number is entered results will include addresses within three 3 blocks. Tenaya Way 118 Las.

Certain Tax Records are considered public record which means they are available to the public. Henderson City Hall 240 S. 4 beds 2 baths 1308 sq.

Please call 702 455-4997 to discuss your value andor have an appeal form mailed or emailed to you. Search the City of Las Vegas property assessment records by parcel number owner name or street name. Assessor - Personal Property Taxes.

123 Main St City State and Zip entry fields are optional.

6532 Moon Roses Ct Las Vegas Nv 89108 Mls 2378870 Zillow

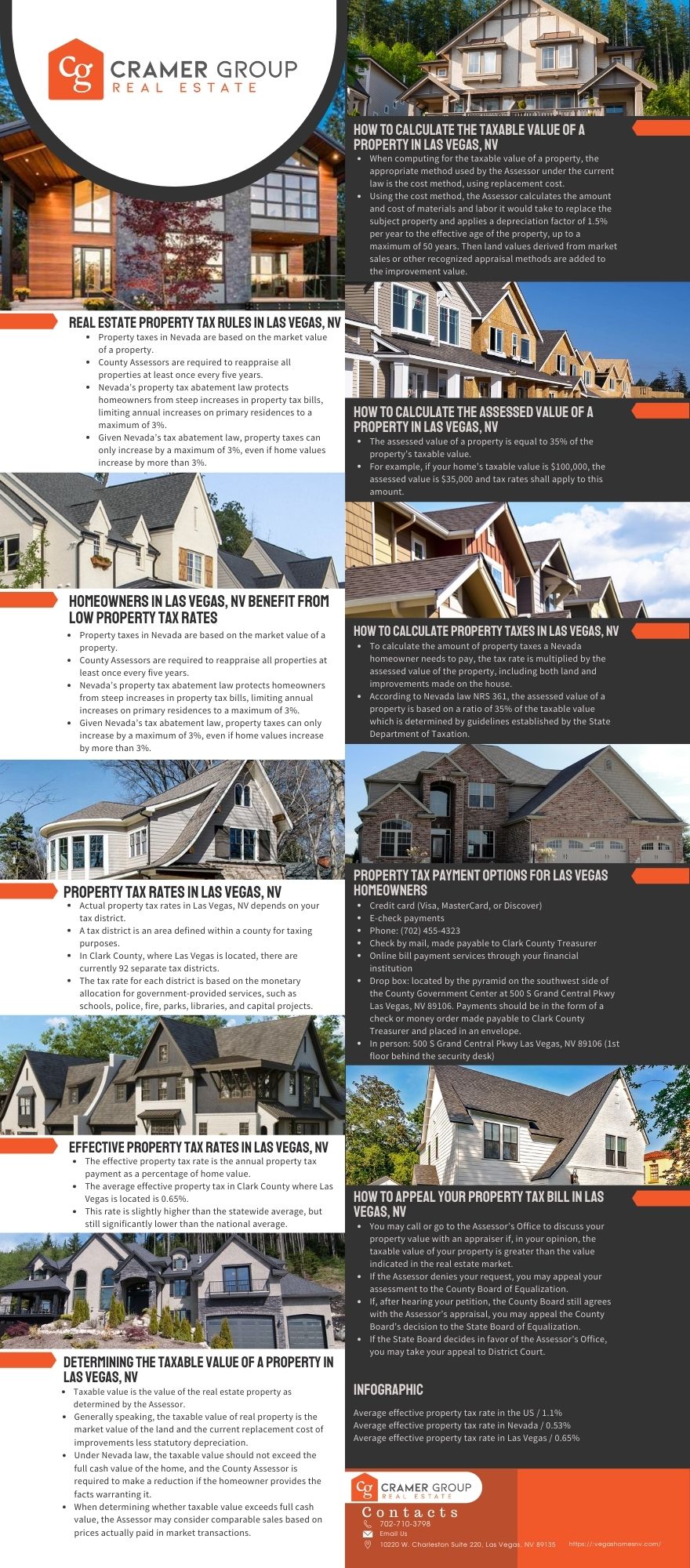

Calculating Las Vegas Property Taxes Las Vegas Real Estate Las Vegas Homes For Sale Las Vegas Real Estate

High Rise Condo Property Taxes Las Vegas High Rise Condo Living Savi Realty

Nadel Architecture Completes 155 000 Sf Expansion At Showcase Mall In Las Vegas Rebusinessonline

Nevada Tax Rates And Benefits Living In Nevada Saves Money

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

7033 Villada St North Las Vegas Nv 89084 Mls 2392280 Zillow

2317 Palomino Ln Las Vegas Nv 89107 Mls 2397765 Zillow

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

4773 Mereworth Ct Las Vegas Nv 89130 Zillow

4588 Skybolt St Las Vegas Nv 89115 Mls 2396275 Zillow

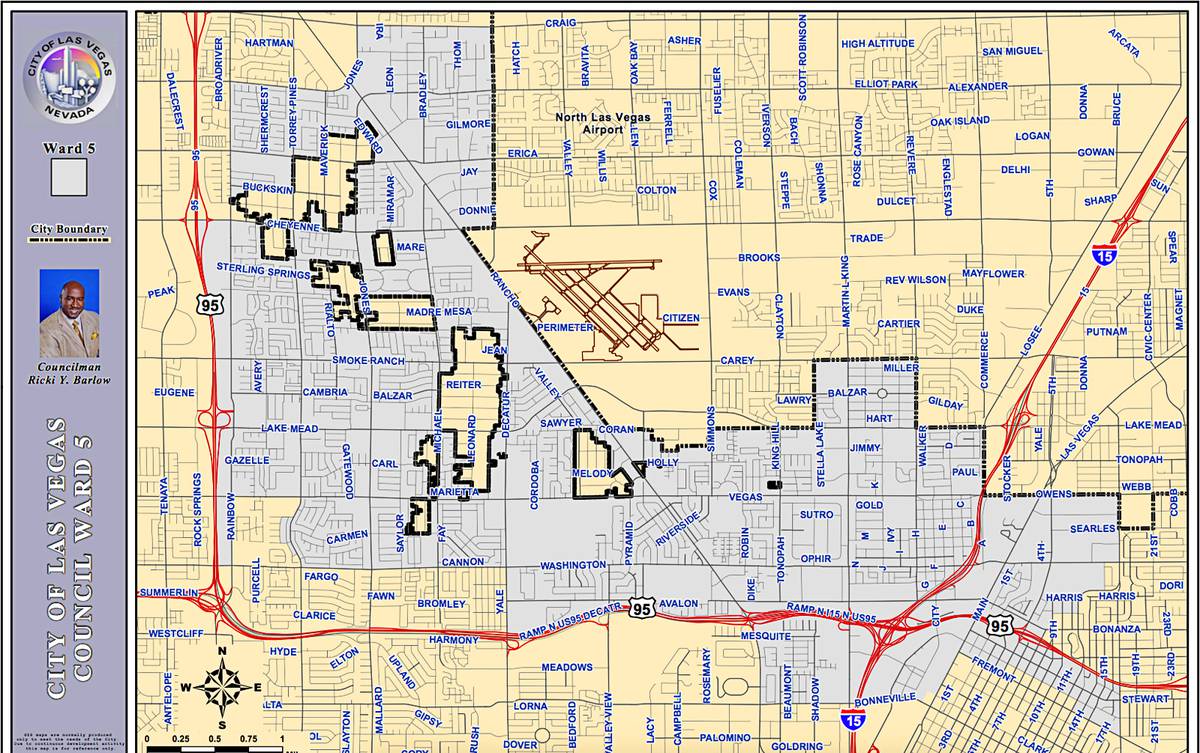

Las Vegas Plan To Annex Small Portions Of Clark County Fuels A Flare Up Las Vegas Sun News

608 Tecate Valley St Las Vegas Nv 89138 Mls 2348800 Zillow

10941 Fort Valley Ave Las Vegas Nv 89134 Mls 2394926 Zillow

328 Vista Glen St Las Vegas Nv 89145 Mls 2375340 Zillow

How To Protect Real Property From Fraud Las Vegas Probate Attorney Near Me