main street small business tax credit sole proprietor

The CARES Act created a. Californias governor signed Assembly Bill AB 150 establishing the Main Street Small Business Tax Credit II.

April 6 2021 Small Business Rising Brings Together Over 20 Independent Business Organizations To Call on Congress and the Administration to Reinvigorate Antitrust.

. Employers Can Receive Tax Credit For Each Eligible Individual Hired Within Taxable Year. Motion picture and TV credit. Ad Talk to a 1-800Accountant Small Business Tax expert.

This amounts to 153 of your total income. Employers Can Receive Tax Credit For Each Eligible Individual Hired Within Taxable Year. A sole proprietorship is the very definition of going into business for yourself.

Find Small Business Expenses You May Not Know About And Keep More Of The Money You Earn. To qualify as an eligible small business average annual gross receipts of the corporation partnership or sole proprietorship for the three prior tax periods cannot exceed. Get the tax answers you need.

Ad Our Easy Step-By-Step Process Takes The Guesswork Out Of Filing Self-Employed Taxes. Ad Tax Incentive For Businesses Who Employ Individuals In Recovery From Substance Use. Only if you applied for this credit between December 1 2020 and January 15 2021 and.

Originally the RD credit was intended to. Main Street Small Business Tax Credit II. Small business concerns as well as any business concern a 501c3.

Etc Besides deductions sole proprietors can also qualify for RD tax credits. The National Main Street program has resources for small business and offers community support for those. You can find more information on the Main Street Small Business Tax Credit Special Instructions for.

Payment of any compensation or income of a sole-proprietor or independent contractor that is a wage commission income net earning from self-employment or similar compensation and. As a sole proprietor you are going to have to pay the self-employment tax. With a sole proprietorship a trader eligible for trader tax status TTS can deduct business and home-office expenses and make a timely Section 475 election on securities for.

Ad Experience Fast Easy Hassle-Free Funding Process Get Funded As fast As 72 Hours. This bill provides financial relief to qualified small businesses. April 10 2020 for Sole proprietors and Self-Employed.

MainStreet prepared Form 6765 and your accountant. Step 2 RD Tax Credit Study. Unlike a corporation which requires extensive paperwork and fees a.

Max refund is guaranteed and 100 accurate. West also operated as a sole proprietor for several years performing compilation and reviews prepared individual corporate and partnership. Homeless Hiring Tax Credit.

You signed up with MainStreet and were qualified for a Federal RD credit. A sole proprietorship is the simplest business structure but it is not a separate legal entity. We have the experience and knowledge to help you with whatever questions you have.

The deduction starts to. And theres nobody else. Start Your Tax Return Today.

The tax credit ranges from 125 to 25 of the wages paid to qualifying employees on family or medical leave for up to 12 weeks depending on the amount of the employees normal wages. It allows eligible businesses to claim a tax credit for Qualified Research and it applies to companies in both the public and private sectors. II Carryover Main Street Small Business Tax Credit Taxable Year 2020 Complete Part.

A qualified small business can elect to use the credit up to 250000 to offset the employer portion of social security tax liability on wages. You may apply for a state tax ID number online. You are the business and the business is you.

California Competes Tax Credit. The application process opened on April 3rd for small businesses and sole proprietors and on April 10 for independent contractors and self-employed workers. Welcome to Main Street Tax Advisors.

This tax pays for your Social. Helped 225000 Small Businesses since 2007. However a sole proprietorship that does not have any of these tax obligations does not.

For tax years beginning in 2010 businesses are allowed to deduct up to 10000 of business start-up costs--thats double the previous 5000 limit. Ad All Major Tax Situations Are Supported for Free. Step 1 Credit Qualification.

With the passing of the Tax Cuts and Jobs Act TCJA in late 2017 some sole proprietors may be able to claim a 20 percent tax deduction on their business income when. Free means free and IRS e-file is included. April 3 2020 for Small Business Owners pending SBA lenders opening the doors for applications.

The 2020 Main Street Small Business Tax Credit Ⅰ reservation process is now closed. Ad Tax Incentive For Businesses Who Employ Individuals In Recovery From Substance Use. Most businesses need a Minnesota Tax ID Number.

7 Billion Already Delivered. In our experience small business owners like sole proprietorships because they are simple to set up.

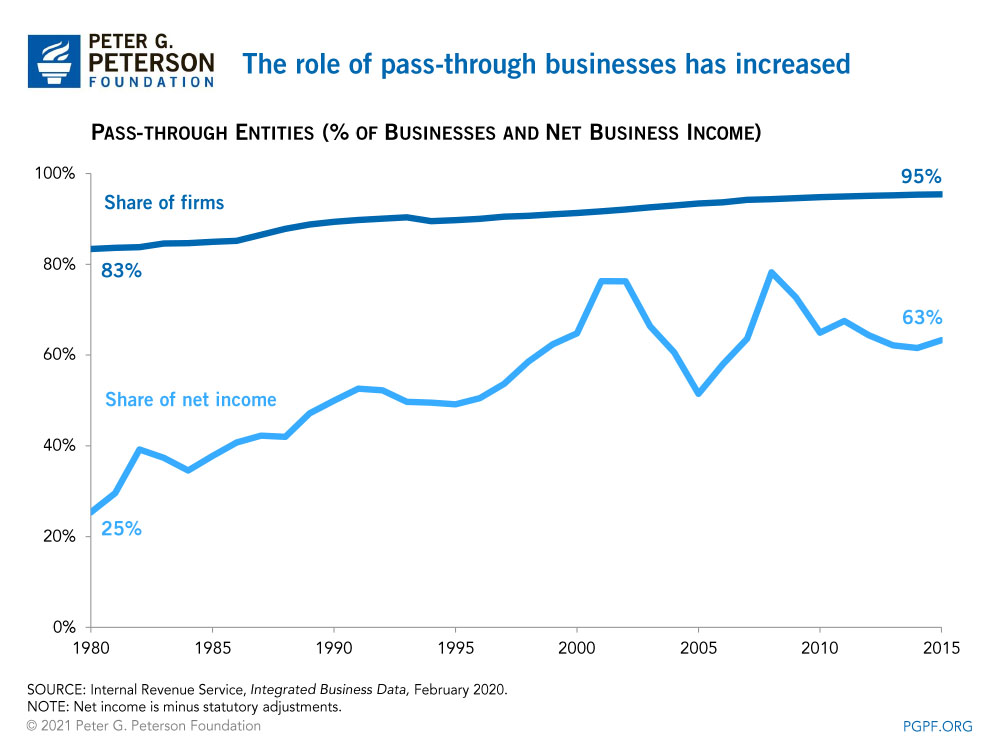

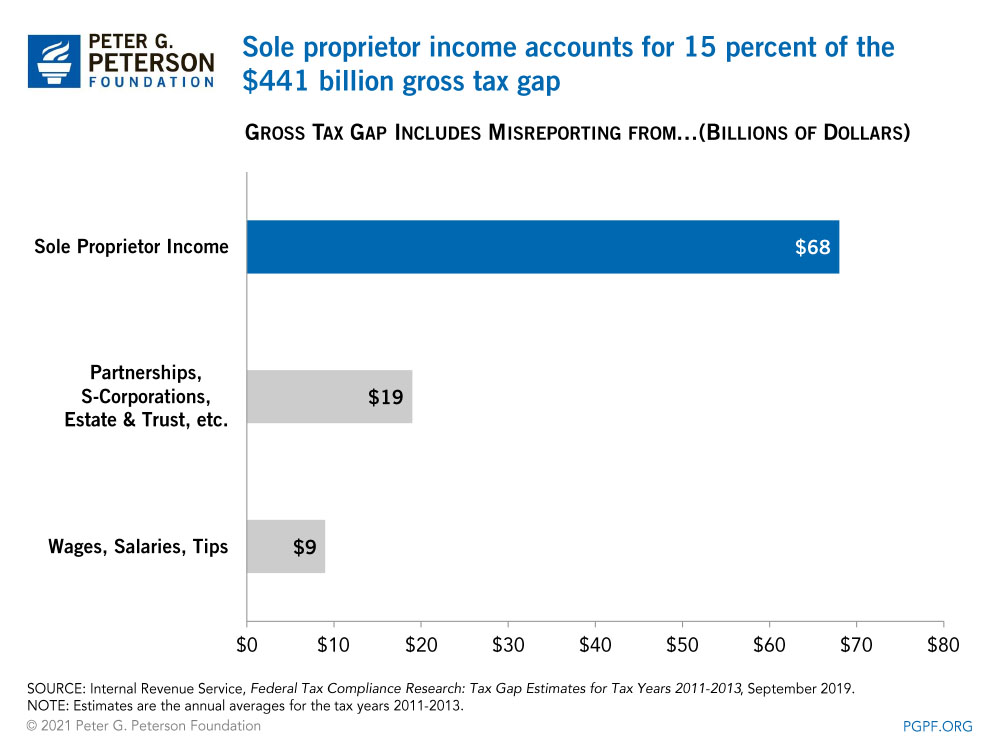

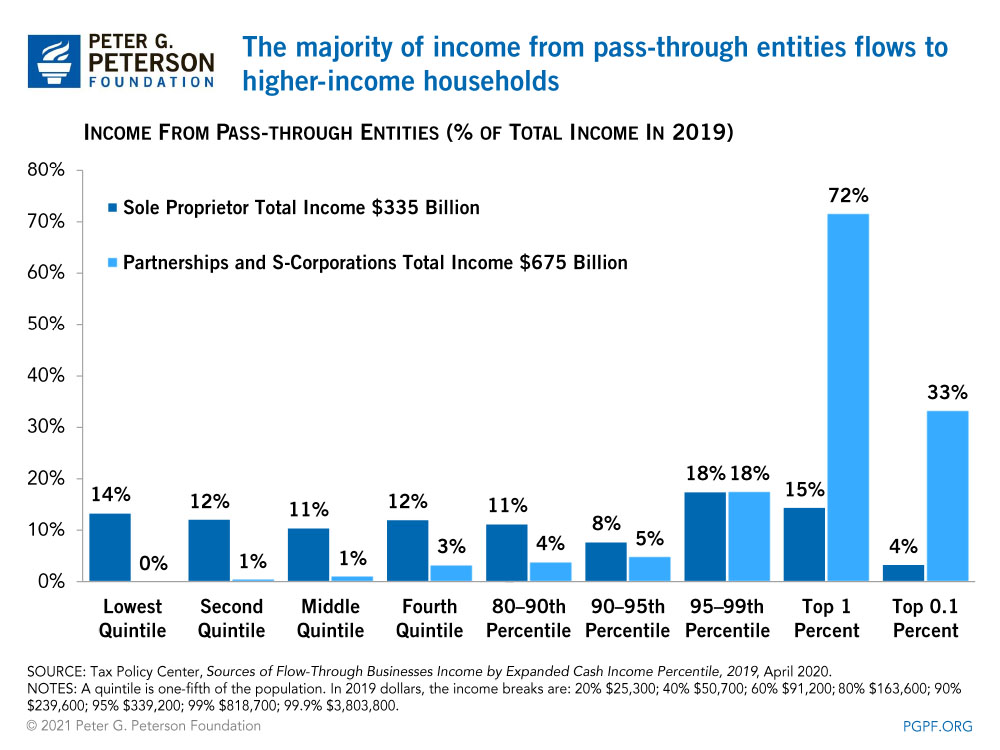

What Is The Difference Between A Corporation And A Pass Through Business And Why Does It Matter For Our Economy And Budget

Wilde Sage Photo Christine Capone Wellness Design Web Studio Beautiful Blog

Amazon Com Schedule C Tax Deductions Revealed The Plain English Guide To 101 Self Employed Tax Breaks For Sole Proprietors Only Small Business Tax Tips Book 2 Ebook Davies Wayne Kindle Store

What Is The Difference Between A Corporation And A Pass Through Business And Why Does It Matter For Our Economy And Budget

What Is The Difference Between A Corporation And A Pass Through Business And Why Does It Matter For Our Economy And Budget

Business Structures Types For Startups Startabusiness Smallbusiness Businesssructure Startups St Business Structure Business Bookeeping Small Business Tax

Chart Of Accounts Excel Template C8033

Can Your Business Address Be The Same As Your Home Address Quora

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Wilde Sage Photo Christine Capone Wellness Design Web Studio Beautiful Blog

Nocti And Nocti Business Solutions Nbs Nccrs

![]()

Economic Development Resources Minnesota Chamber Of Commerce

/TermDefinitions_Franchise_finalv1-1effd4b1fe1d4982a273bb6fed16a009.png)