GST payment

The Canada Revenue Agency will pay out the GSTHST credit for 2022 on these due dates. 22 hours agoThis increases the maximum GSTHST credit amounts by 50 per cent for the 2022-2023 benefit year according to the bill.

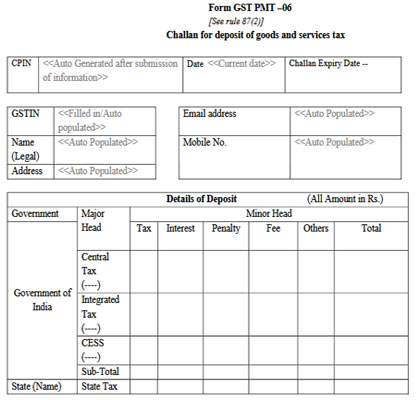

Gst Payment Challan Gst Pmt 06 Masters India

Tax refunds made via PayNow receiving GST and Corporate Tax refunds and GIRO will be received within 7 days from the.

. GSTHST Payment Dates for 2022. 4 2022 CNW Telbec - The first of the Government of Canadas new financial support measures will take effect this Friday November 4 2022 with the. Each child under the age of 19.

Payments can be received. Monthly if your GST turnover is 20 million or more. For example the taxable period ending 31 May is due 28 June.

4 2022 CNW Telbec - The first of the Government of Canadas new financial support measures will take effect this Friday November 4 2022 with the. Grievance against PaymentGST PMT-07. Find out what happens if your business does not submit a GST return and or pay tax due by the required date.

Goods and Services Tax. Canadians eligible for the GST rebate can expect to receive an additional lump sum. The payment dates for GST and HST this year are.

To support those most affected by inflation the Government of Canada is issuing an additional 25 billion through GST credit payments to assist more than 11 million Canadian individuals. Note that July 2022 to June 2023 payment will be the start of a new calendar year for GST payments and it will be based on your 2021 tax returns. For the 2021 base year.

Your goods will be released automatically when they arrive in Jersey although you wont benefit from the de minimus you. This is the 28th of the month after the end of your taxable period. The GST credit boost will result in recipients receiving a 50 increase on their GST payment benefits for the 2022-2023 year.

20 hours agoOTTAWA ON Nov. If you do not receive your GSTHST credit. How to pay GST.

In 2022 the payment dates are as follows and are based on your 2020 return. A sign outside the Canada Revenue Agency is seen in Ottawa Monday May 10 2021. My business is not GST-registered but is Customs-approved.

Single Canadians qualify for a GST HST credit if you earn. What are the simple steps for GST payment online. OTTAWA ON Nov.

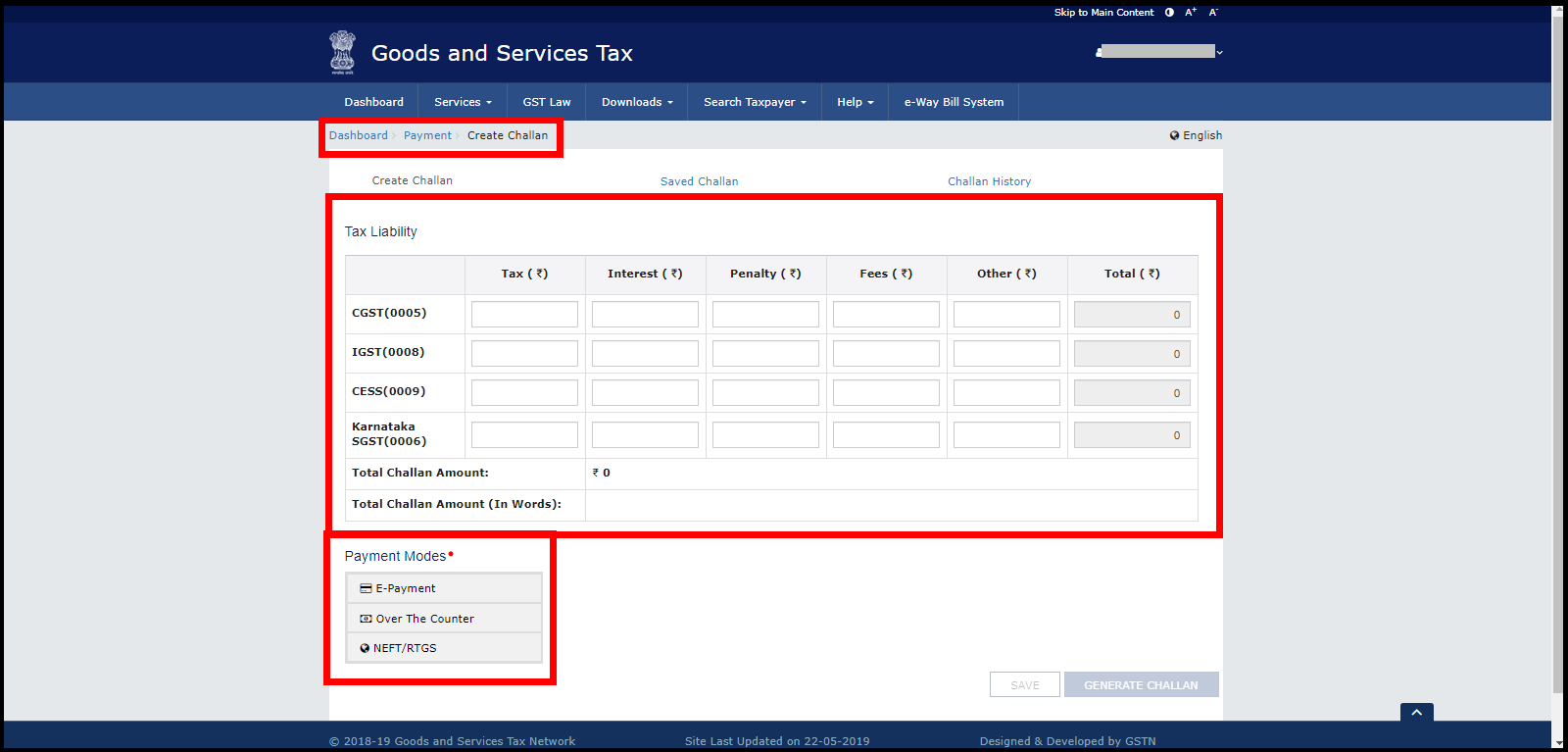

Story continues below advertisement We absolutely. And in 2023 the payment dates. First step- login to the GST portal The second step- go to the Services menu PaymentsCreate challan or direct create.

Generally tax credits of at least 15 are automatically refunded. Quarterly if your GST turnover is less than 20 million and we have. 17 hours agoThe tax credit only applies to Canadians who earn 60000 or less annually.

Goods Services Tax GST Login. Your GST reporting and payment cycle will be one of the following. Find out how you can pay your GST for imports or goods and.

60000 and have 3 or 4 children. The Canada Revenue Agency usually send the GSTHST credit payments on the fifth day of July October January and April. GST Payment Dates in 2022.

Your GST payment is due on the same day as your GST return.

Gst Payment Online How To Pay Gst Online Safexbikes Blog

How To Make Gst Payment Modes Step By Step Guide And Tips For Gst Payment

Bas Payment Of Gst Payg Jcurve Solutions

Gst Payment Challan How To Make Gst Payments Vakilsearch

How To Create Gst Payment Challan In Portal Baba Tax

Due Dates Of Gst Payment With Penalty Charges On Late Payment

Track Gst Payment Status Online Learn By Quicko

Create Gst Payment Challan Step By Step Guide On Gst Portal Indiafilings

How To Link Gst Payment By Neft Or Rtgs To Gst Challan Youtube

Gst Payment Dates 2022 2023 Gst Double Payment Explained

How To Make Gst Payment Gst Payment Process Gst Create Challan

Gst Challan Payment With Pdf Format And Download Process

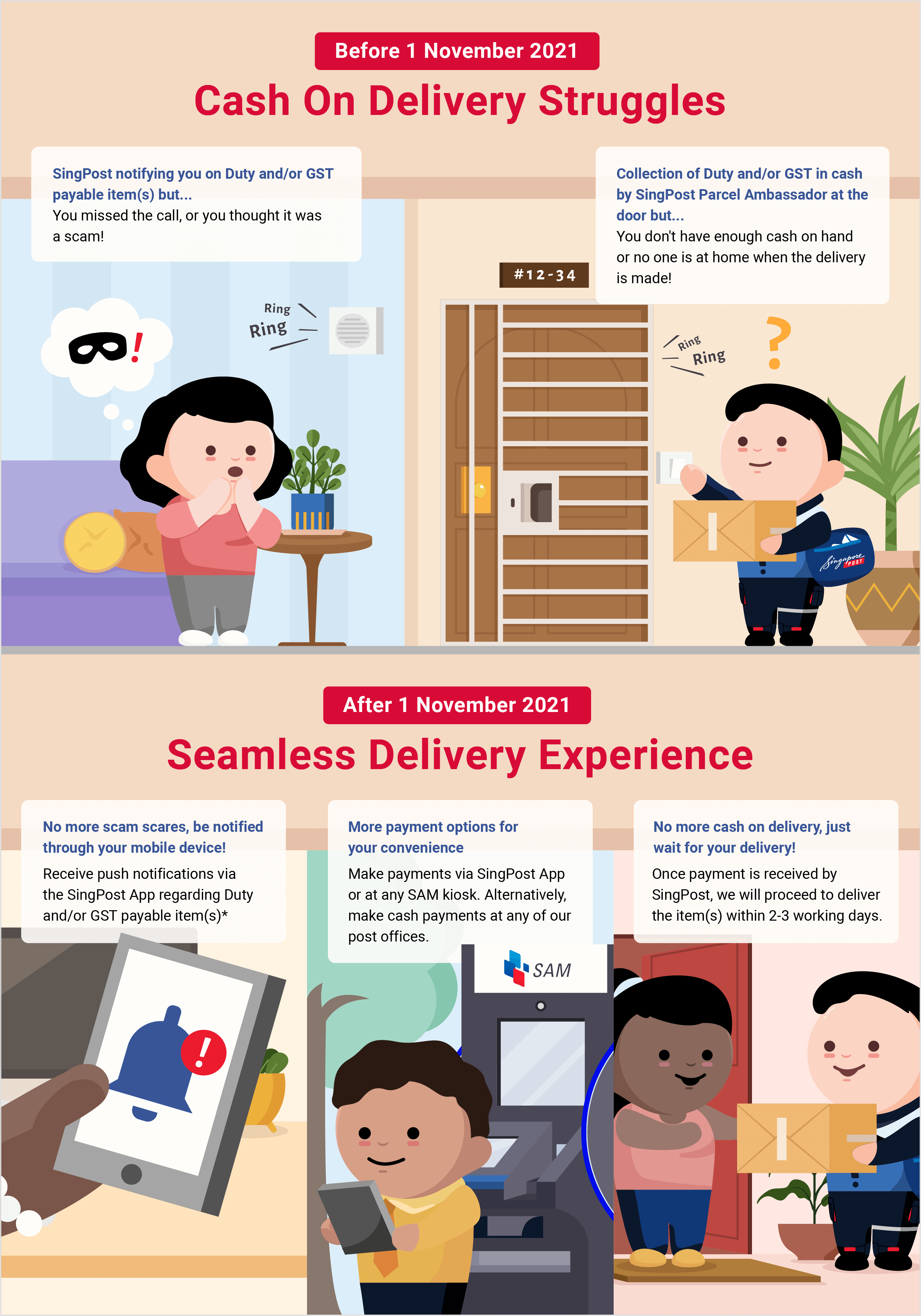

Gst Duty Payment Singapore Post